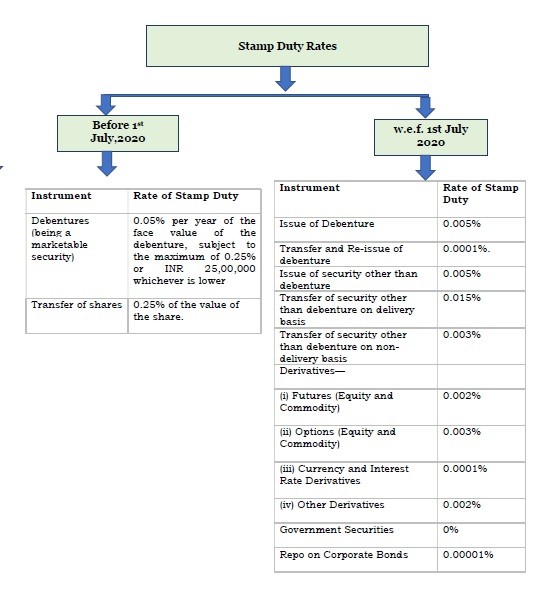

Revised rate of Stamp Duty and recent changes under Indian Stamp Act, 1899 (Levy & its Collection) w.e.f 1st July, 2020

Before amendment, the system of collection of stamp duty on securities market transactions has led to multiple rates for the same instrument, resulting in jurisdictional disputes and multiple incidences of duty, thereby raising the transaction costs in the securities market, and hurting capital formation.

Government of India, through Finance Act, 2019, has amended the Indian Stamp Act 1899, and relevant Stamp Rules, 2019.

Commencement: Amendments were notified on December 10, 2019 and come into force from 9 January 2020, which was later extended to 1 April 2020 vide notifications dated 8 January,2020 and was further extended to 1 July 2020 vide notifications dated 30 March 2020.

Hence, the revised Act has come into effect from July 1, 2020.

Key benefits :-

ü Single Window: Central Government has created the legal and institutional mechanism to enable States to collect stamp duty on securities market instruments at one place by one agency (through the Stock Exchanges or Clearing Corporations authorised by the Stock Exchange or by the Depositories) on one instrument.

ü Simplification: Stamp duty now payable either by the buyer or by the seller but not by both, except in case of certain instrument of exchange where the stamp duty shall be borne by both parties in equal proportion.

ü Uniformity: Amendment will bring in uniformity and affordability of the stamp duty on securities across States and thereby build a pan-India securities market.

ü Reduce Collection Cost: Cost of collection would be minimised while revenue productivity is enhanced

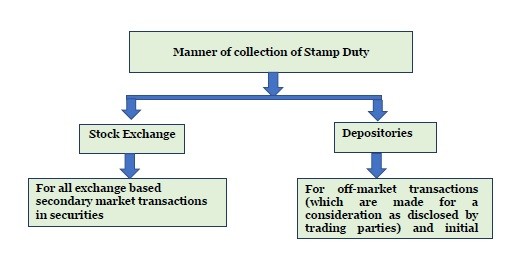

Manner of Collection of the Stamp Duty

The stamp-duty on

Ø sale of securities,

Ø transfer of securities and

Ø issue of securities

shall be collected on behalf of the State Government by the Stock Exchange or Clearing Corporation authorized or Depositories (authorized collecting agents).

The Central Government has also notified the Clearing Corporation of India Limited (CCIL) and the Registrars to Issue and / or Share Transfer Agents to act as collecting agents.

The stamp-duty collected on behalf of the State Government shall not be utilized by any collecting agent for any other purpose and shall be transferred to the State Government. The State Government shall appoint a nodal officer for all official communications with the principal officers (appointed representatives of collecting agents) for the purposes of collection of stamp-duty in accordance with stamp duty Rules.

Stamp Duty is not applicable on the followings:-

I. Bonus Issue of Shares

In case of bonus issue, there is no consideration which means bonus shares are issued free to existing shareholders. Section 21 of the Amended Indian Stamp Act read with sub-section 16B of Section 2 clearly indicates that stamp duty is to be collected on market value which is based on price or consideration involved

II. On redemption of Mutual Fund units

Redemption is not liable to duty as it is neither a transfer nor an issue nor a sale.

III. Transfer of securities without consideration such on gift, legacy transfer etc.

No. Section 21 of the Amended Indian Stamp Act read with sub-section 16B of Section 2 clearly indicates that stamp duty is to be collected on market value which is based on price or consideration involved.

IV. In case of Creation of segregated portfolio

No. Since no consideration is received from the investors and the mechanism is only to facilitate mutual funds to deal with liquidity risk leading to equal treatment of all investors, issuance of units in segregated portfolio is not liable to stamp duty.

V. In case of conversion of holding from Dematerialisation into Statement of Account (SoA) form and vice versa

No. Conversion of existing mutual fund units held in SoA mode to demat mode or vice-versa does not tantamount to issuance or transfer of mutual fund units and it only reflects the change in mode of holding without any change in beneficiary ownership. Accordingly, stamp duty is not applicable on such conversions.