Description

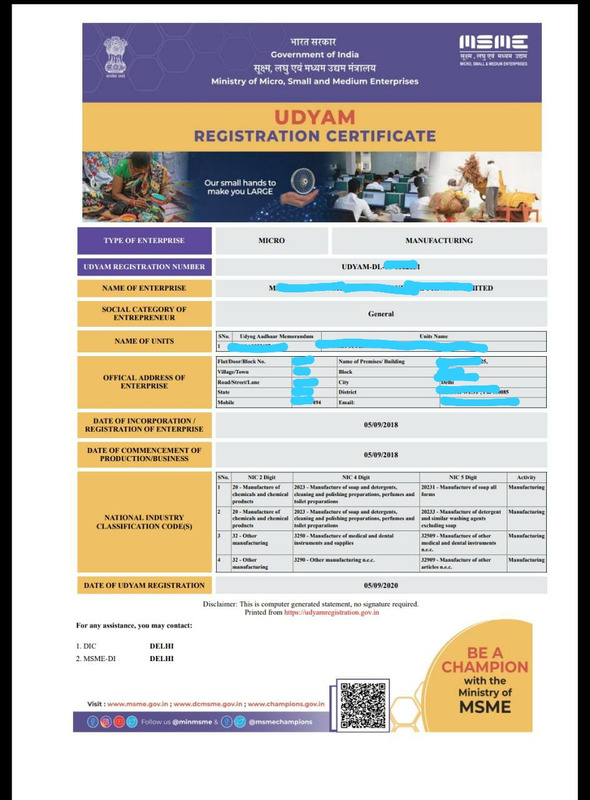

MSME Registration:-

Description: – Micro, small and medium enterprises and any enterprise that falls under any of these three categories. The Government of India through various subsidies, schemes and incentives promote MSMEs through the MSMED Act. To avail of the benefits under the MSMED Act from the Central or State Government and the Banking Sector, MSME Registration is required.

-

The full form of MSME is Micro, Small or Medium Enterprises

-

How we can classify the enterprises as MSME?

We can classify on the basis of the following criteria:-

(i) A Micro enterprise, where the investment in plant and machinery or equipment does not exceed one crore rupees and turnover does not exceed five crore rupees;

(ii) A Small enterprise, where the investment in plant and machinery or equipment does not exceed ten crore rupees and turnover does not exceed fifty crore rupees; and

(iii) A Medium enterprise, where the investment in plant and machinery or equipment does not exceed fifty crore rupees and turnover does not exceed two hundred and fifty crore rupees.

Benefits of MSME Registration:

- Eligibility for lower rates of interest,

- Excise exemption schemes,

- Tax subsidies,

- Power tariff subsidies,

- Capital investment subsidies,

- 50% concession in the Govt fees while filing trademark application in case of body corporate.

- Easy Loan support from Banks and Many more.

- Benefit of Schemes of Ministry of MSMEs such as :-

- Credit Guarantee Scheme

- Public Procurement Policy,

- additional edge in Government Tenders

- Protection against delayed payment etc.

MSME Registration Procedure

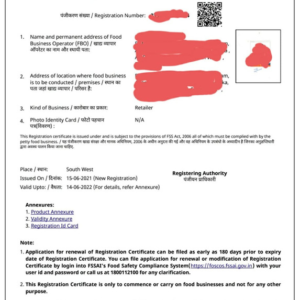

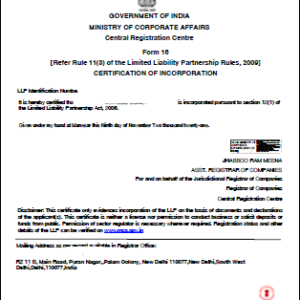

Following information/details is required to fill in the application of MSME/Udyam Registration certificate:-

- First step is Aadhar Verification:- Aadhar no is required for the Udyam Registration, The Aadhar number shall be of the proprietor in the case of a proprietorship firm, of the managing partner in the case of a partnership firm and of a karta in the case of a Hindu Undivided Family (HUF) and in case of body corporate authorized signatory shall provide its Aadhar no.

- Proprietor/Organization PAN No.

- Proprietor /Organization GST no

- Have you filed the ITR of the previous year (Yes/No)

- Mobile No

- Email Id

- Social category (General/OBC/ST/SC)

- Registered address of the business unit

- Date of Incorporation/Registration (Certificate of Incorporation of body corporate)

- Business Activity :- Manufacturing /Services/ Trading

- Written Down Value, Exclusion of cost of pollution control, Research & Development and Industrial Safety Devices, Net Investment in plant and Machinery or Equipment

- Turnover

- Are you interesting in getting registered in government e-Market (Gem) Portal (Yes/No)

- Are you interesting in getting registered on TReDS Portals (one or more) (Yes/No)

- Are you interesting in getting registered on National Career Services(NCS) Portal (Yes/No)

- Are you interesting in getting registered on NSIC B2B Portal

- Are you interesting in availing free .in Domain and a business Email Id

- Submission of form by generating OTP

Regards,

CS Aarti Kumari

+917428522985

Reviews

There are no reviews yet.