Description

Trust / Society Registration:

Benefits of Trust / Society Registration:

- Useful for Charitable Entity.

- Trust can accept donation in good faith.

- Long Term Tax benefits.

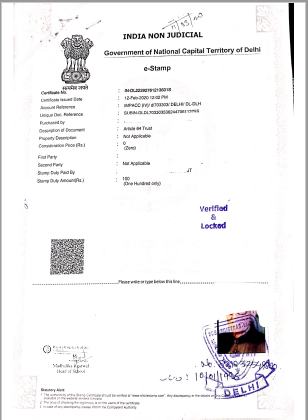

- Created by virtue of Deed and required to be registered with Sub- Registrar.

What you will Get?

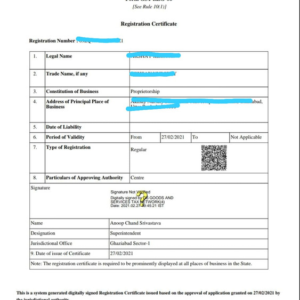

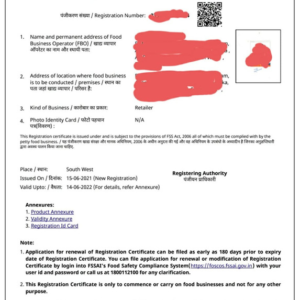

Registered Trust Deed / Society Deed

Get your Trust / Society Registration Now!!

Reviews

There are no reviews yet.