Description

Registration of Limited Liability Partnership (LLP)

Limited Liability Partnership (LLP), as the name showing that in LLP the liability of partners is not unlimited its limited. The Personal Risk in LLP of partners is Limited. The partners of LLP act as per the agreement entered into between the partners that we called Limited Liability partnership. The agreement is governed by the Limited Liability Partnership Act, 2008. Minimum two partners are required for formation of LLP. If we compare LLP with private company the cost of Maintenance and compliances are less than the private company. It is easy to incorporate a LLP.

Benefits of registration of LLP

- Limited Liability of Partners (Liability of the partners is limited to their agreed contribution.)

- Separate Legal Entity/ Artificial Person

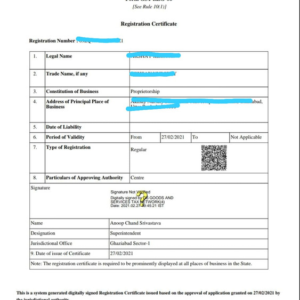

- Government Recognition

- Low Compliances

- Easy Exit procedure

- Going Concern

- No Minimum Capital Required

- Easy to get Business Loans

- Build Trust etc.

What Basic requirement for forming a LLP:-

- Capital Contribution

- Minimum two Designated Partners

Steps of forming a LLP:-

There are two main steps of forming LLP

- Name Reservation form: – To form a LLP firstly we have to decide what will be the name of the LLP. Firstly we apply for reservation of LLP Name. For filing this form we required the following Information:-

- Two proposed name

- Business activity that will LLP carry after its formation

- LLP registration form:-After approval of name reservation form we will apply for LLP registration by filing online form.

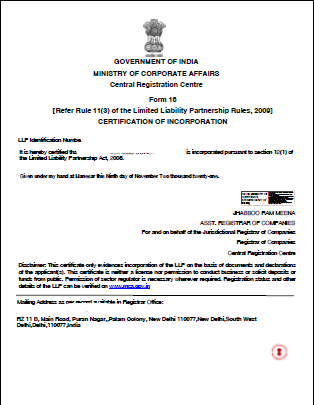

In how many days you will get your LLP registered?

LLP formation is entirely an online Procedure. You will get the registration certificate within a week of submission of form.

What you will get?

- Certificate of Incorporation

- Class – 3 Digital Signature Certificate

- Partnership Deed.

- PAN / TAN

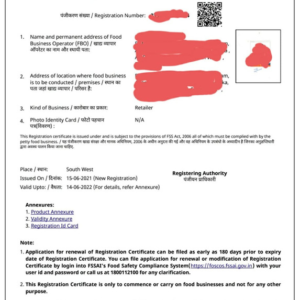

- GST Registration

Reviews

There are no reviews yet.